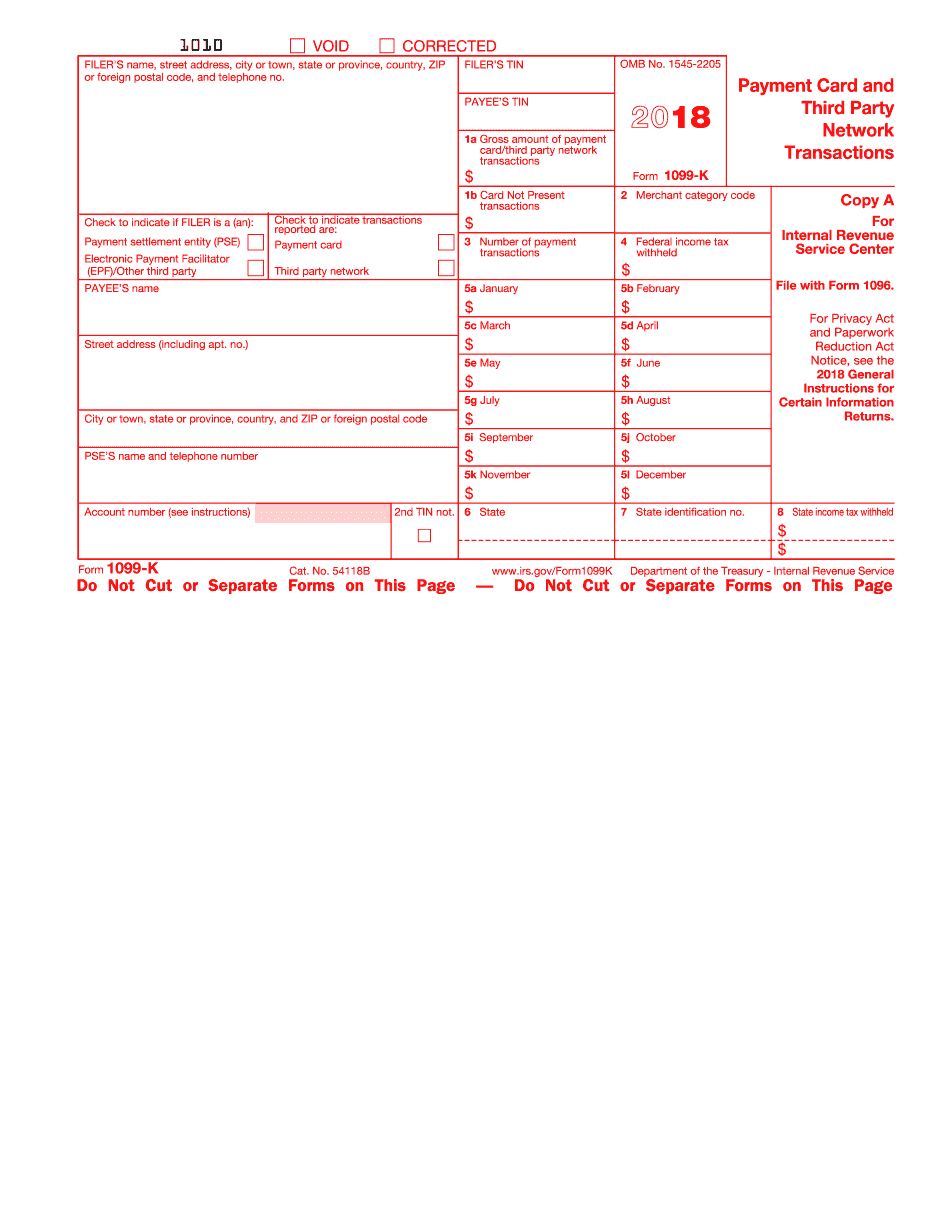

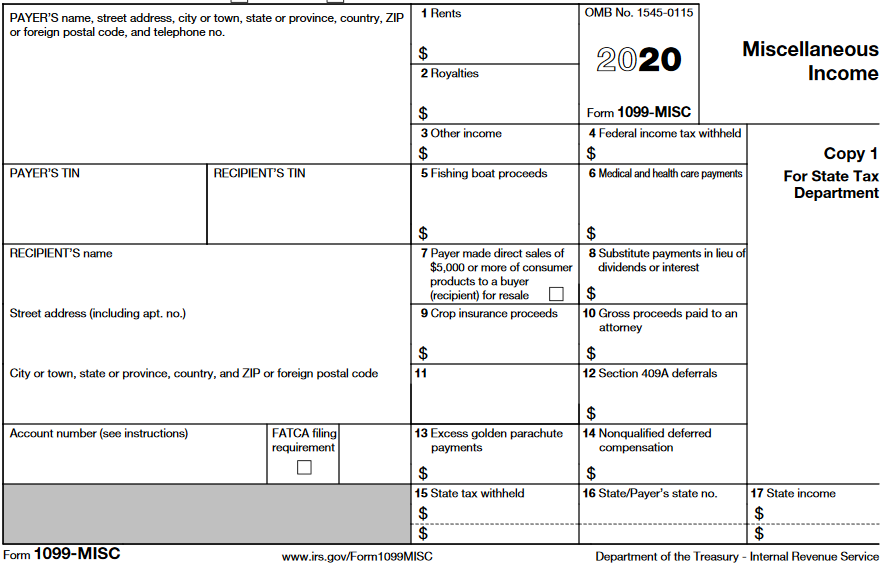

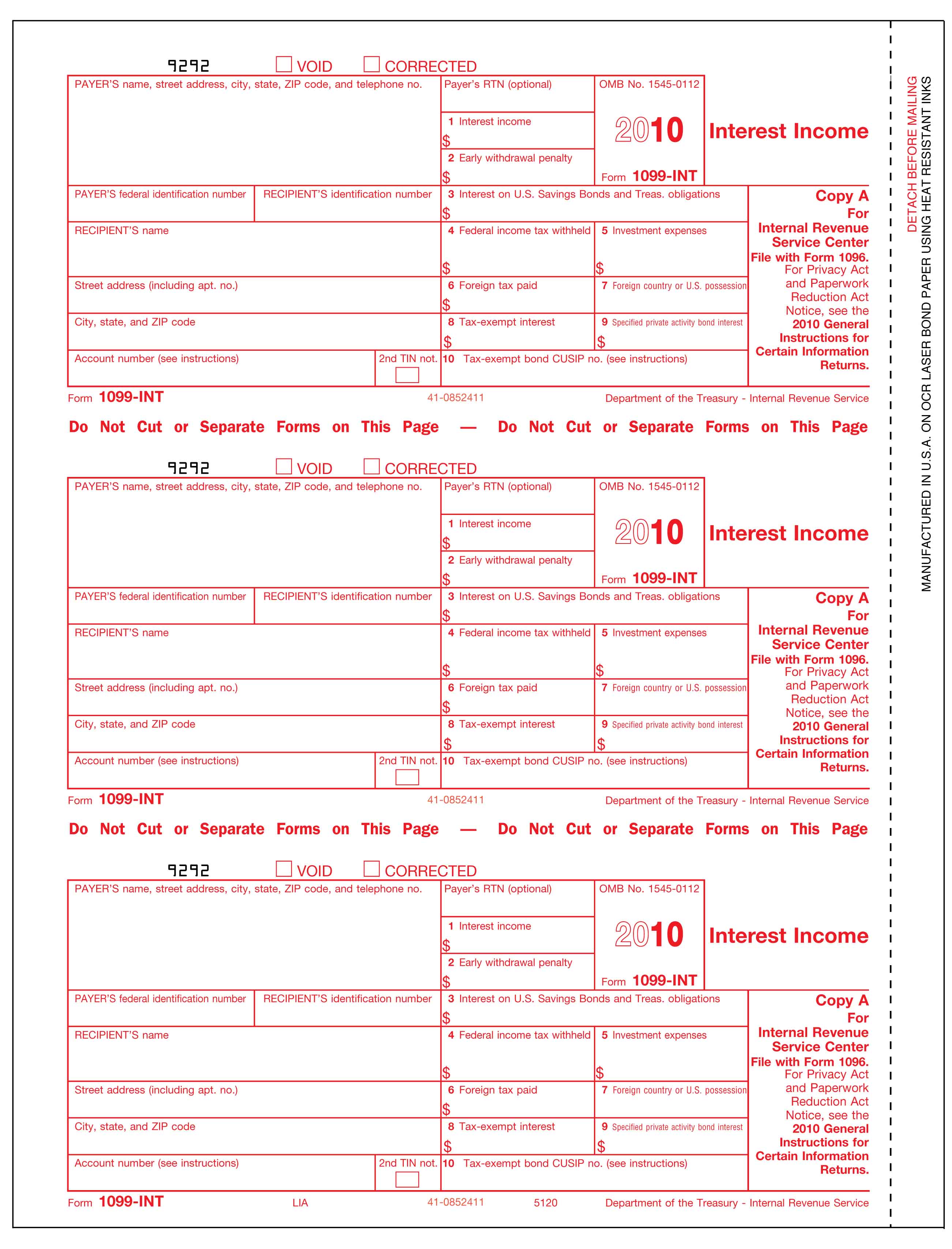

1099 Form Printable Template

1099 Form Printable Template - If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Go to www.irs.gov/freefile to see if you. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. What is a 1099 form? Copy a is for informational purposes only and copy b is. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. The latest versions of irs forms, instructions, and publications. There are nearly two dozen different kinds of 1099 forms, and each. Staying informed about the 1099 forms ensures you capture every necessary detail, keeping you compliant and. Copy a is for informational purposes only and copy b is. There are nearly two dozen different kinds of 1099 forms, and each. If you’re unsure, always consult the irs 1099 form guidelines. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. It helps businesses accurately disclose payments made to freelancers or. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. The latest versions of irs forms, instructions, and publications. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Staying informed about the 1099 forms ensures you capture every necessary detail, keeping you compliant and. If you’re unsure, always consult the irs 1099 form guidelines. Do not file this copy with the irs, as it is not. The latest versions of irs forms, instructions, and publications. Easily align and print your. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Download a printable irs form 1099 to your device | create your template on the lawrina portal. Copy a is for informational purposes only and copy b is. Staying informed about the 1099 forms ensures you capture every necessary detail, keeping you compliant and. A 1099 form is a tax form used by independent contractors or freelancers to report income. Copy a is for informational purposes only and copy b is. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. A 1099 form is a tax form used by. If you’re unsure, always consult the irs 1099 form guidelines. A 1099 form is a tax form used by independent contractors or freelancers to report income other than wages, salary, and tips. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Easily align and print your. It helps businesses accurately disclose payments made. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Download and print the official irs form for reporting nonemployee compensation, such. Staying informed about the 1099 forms ensures you capture every necessary detail, keeping you compliant and. A 1099 form is a tax form used by independent contractors or freelancers to report income other than wages, salary, and tips. Go to www.irs.gov/freefile to see if you. It helps businesses accurately disclose payments made to freelancers or. The latest versions of irs. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. What is a 1099 form? Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Download and print the official irs form for reporting nonemployee compensation, such as payments to. What is a 1099 form? There are nearly two dozen different kinds of 1099 forms, and each. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Business taxpayers can file electronically any form 1099 series information returns for free with the. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. There are nearly two dozen different kinds of 1099 forms, and each.. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. What is a 1099 form? Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Our guide describes the basics of. If you’re unsure, always consult the irs 1099 form guidelines. Easily align and print your. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Copy a is for informational purposes only and copy b is. Staying informed about the 1099 forms ensures you capture every necessary detail, keeping you compliant and. A 1099 form is a tax form used by independent contractors or freelancers to report income other than wages, salary, and tips. Download a printable irs form 1099 to your device | create your template on the lawrina portal. There are nearly two dozen different kinds of 1099 forms, and each. It helps businesses accurately disclose payments made to freelancers or. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Download and print the official irs form for reporting nonemployee compensation, such as payments to independent contractors. Go to www.irs.gov/freefile to see if you. What is a 1099 form? If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat.1099 Tax Form Printable Excel Printable Forms Free Online

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

IRS Employee 1099 Form Free Download

1099 Printable Forms

Free Fillable 1099 Tax Form Printable Forms Free Online

1099 Template For Word

1099 Form Printable Template

Print Blank 1099 Form Printable Form, Templates and Letter

Irs Printable 1099 Misc Form Printable Forms Free Online

1099 Printable Forms

Do Not File This Copy With The Irs, As It Is Not.

To Ease Statement Furnishing Requirements, Copies B, 1, And 2 Have Been Made Fillable Online In A Pdf Format Available At Irs.gov/Form1099Misc And Irs.gov/Form1099Nec.

In Five Minutes Or Less!

The Latest Versions Of Irs Forms, Instructions, And Publications.

Related Post:

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)